What is ‘fuck you money?‘

While there’s no dictionary definition, the general understanding of ‘fuck you money’ is the amount of money you’d need to live how you want, with the option of saying ‘fuck you’ to any unwelcome demands.

That number varies for everyone. It’s subjective – not because of what it buys, but because of what it represents; fuck you money is not about the money, it’s about freedom.

Bitcoin is fuck you money

This is not a new idea. There’s some truth to it. Bitcoin is a permissionless, borderless, unconfiscateable, censorship-resistant vehicle for transferring wealth, but it’s not fuck you money – yet.

Disclaimer:

I don’t recommend investments or sell trading strategies, and I’ll spare you the history lessons on how Bitcoin was taken over, as well as any ideological monologues about how Bitcoin has strayed from its original path – this article isn’t about any of that.

No, this article is about how cryptocurrencies can become a universally accepted medium-of-exchange that is resistant to all forms of capture, the ultimate tool for censorship-resistance.

In fact, all of crypto is about that.

Censorship-resistance

In the first paragraph of the Bitcoin white paper, Satoshi lays out the reasons for Bitcoin, among them: Bitcoin’s ability to disintermediate. Satoshi frames this property in the context of efficiency gains created for users. While Bitcoin provides some cost savings compared to traditional payments infrastructure, the unique value proposition of blockchain-based applications is somewhat emergent: censorship-resistance.

It’s unclear whether Satoshi viewed censorship-resistance as a unique value proposition of Bitcoin, but censorship-resistance is clearly desirable for many of those using cryptocurrencies today. Furthermore, censorship-resistance is the only 10x value proposition of blockchains. All other benefits are achievable with preexisting technologies at a lower cost.

Bitcoin is only partly censorship-resistant

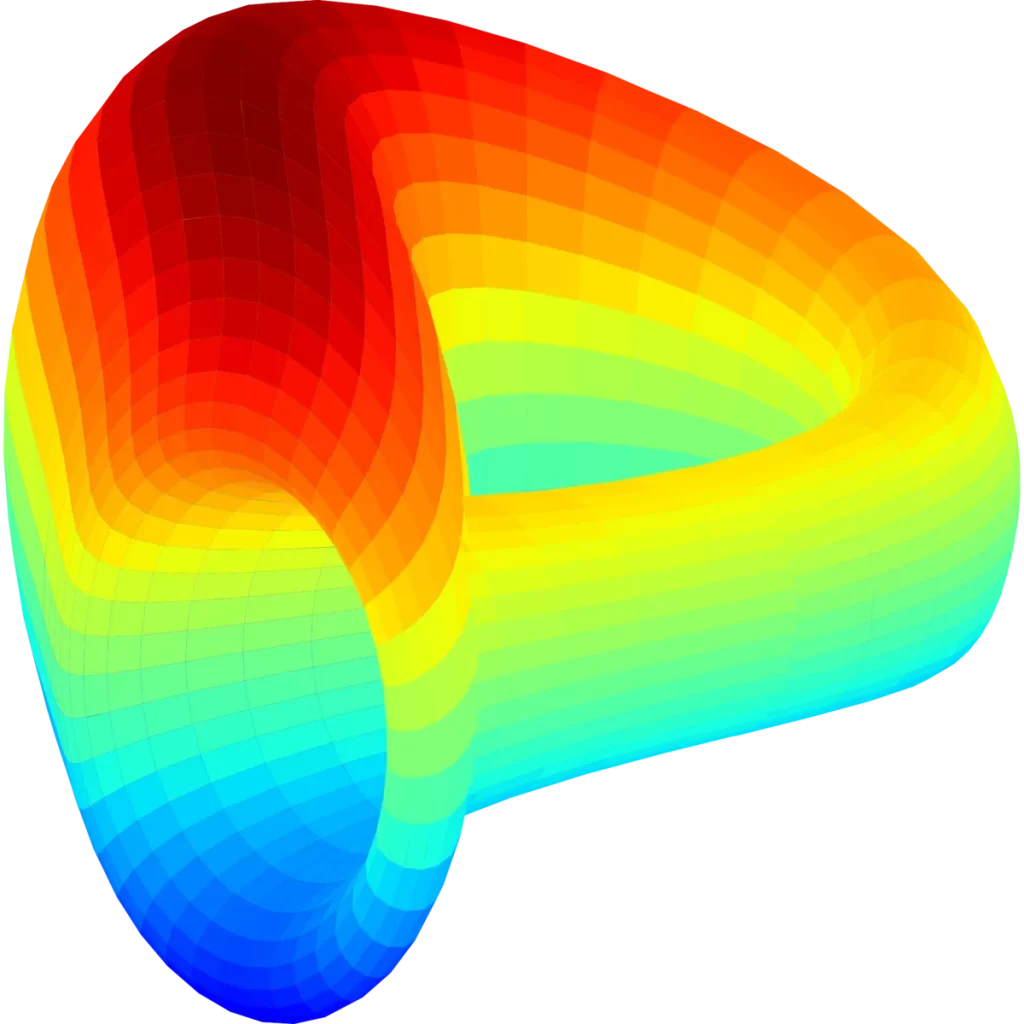

In my talk at Token Engineering Barcamp in July, I described how censorship-resistance comes from the convergence of two properties: permissionlessness and privacy. Bitcoin has one; consequently, its been losing market share as a medium of exchange, a context where both properties are desirable.

Privacy may not at first appear to have much to do with censorship-resistance, but its absence gives rise to an insidious form of censorship – self-censorship.

People are reluctant to take certain actions and positions publicly, as evidenced by the popularity of Twitter anons and alt accounts. People only feel free to share their thoughts given a degree of anonymity.

In smart contracts, this has played out with Tornado Cash.

Tornado Cash

Tornado Cash, a privacy protocol, is censorship-resistant by traditional standards, but it’s not fully censorship-resistant because most of its participants still lack privacy.

This is not a criticism of Tornado Cash. For one, that would be in poor taste given the circumstances. More importantly, there is no way for Tornado Cash to achieve this property. Tornado Cash is built on Ethereum, which is not private by default; privacy, like other economic security constraints, is inherited.

Following the OFAC sanctions of August 2022, participants in Tornado Cash were censored by different means.

- User deposits and withdrawals saw a staggering dropoff following the smart contract’s placement on OFAC’s blocked persons list.

- Token holders stopped participating in governance.

- Relayers quit joining the network.

- Validators refused to include valid transactions which interacted with the Tornado Cash smart contract.

- Certain RPCs refused to provide data to users about Tornado Cash.

- Developers were censored in an extreme form, imprisonment.

Seeing Alexey’s imprisonment, countless other developers have self-censored by declining to release their protocols, creating a chilling effect.

Additional factors

Money is unique among physical goods in that its value depends entirely on a counterparty’s willingness to accept it. This is a deficit of Bitcoin and its competitors. For a combination of reasons outside the scope of this article, not everyone is willing to accept cryptocurrencies. Suffice it to say, adoption as a medium of exchange is a necessary step for Bitcoin and other cryptocurrencies to gain wider adoption.

To do that, it needs a combination of supporting applications – basic banking tools, private means of coordination, and perhaps an entirely private financial system, all with good user interfaces. For the purpose of this article, I’ll call these infrastructure. This infrastructure is what’s needed for Bitcoin and other cryptocurrencies to become “fuck you money.”

The path of innovation

There are two ways to interpret this article’s title – both beg the question. To the first interpretation, I offer the second.

How do you get fuck you money?

You make it.

Bitcoin – as a catch-all for cryptocurrency – is not “fuck you money” yet. It requires applications built around it to draw users who will accept it as a censorship-resistant form of payment.

Getting users should not be hard; people follow their natural economic incentives. Faced with a choice between a CBDC and a censorship-resistant analog with a copycat interface, most of them will choose the latter.

99.99999% of money is not censorship-resistant, including Bitcoin. No money in existence is fuck you money. So to answer the question, how do you make fuck you money – you start by building the infrastructure for it.

There are 3 steps:

- Build protocols which are useful, valuable, secure, and private

- Provide good UIs to those

- Onboard users

For the second, we’ve seen an explosion of talent in UI design pouring in through “Web3” the last couple of years. It may just take a step across the aisle.

And for the third, there are thousands of OG cypherpunks, crypto fanatics, and aligned influencers waiting for a good crypto product to share with their audience. Build these applications with a clean UI/UX and they will share it relentlessly.

Conclusion

So no one has fuck you money – yet.

What is needed for us to get there is not another VC-funded cash-grab, but censorship-resistance. In a world obsessed with how to get fuck you money, there will be plenty along the way for those who actually make it.

And the thing about fuck you money is, once we make it, all money becomes fuck you money.