Category: Tokenomics

The hierarchy of value capture

The hierarchy of value capture is the axis along which protocols and the tokenomic mechanisms they employ can be ordered.

Protocols face a challenge in navigating this hierarchy when designing their value capture: mechanisms in the hierarchy of value capture can be ordered simultaneously as ascending in value capture, and descending in defensibility.

In essence, the more value a protocol captures, the less defensible it is.

This phenomenon epitomizes the tradeoffs between the first two principles of tokenomics: value capture, and utility; it will be helpful to understand a bit about these concepts before reading further.

Utility and value capture have tradeoffs because of their interdependence – the maximum value you can capture is the total value you create. As more value is captured, less is left for consumers.

Value creation, or utility, and value capture in crypto protocols resemble those of traditional companies, but they are not perfect analogs.

In a traditional business, value creation is the total value ascribed by consumers to a product or service; value is most frequently captured through profit, a percentage of the value created.

In crypto, utility is the same – the value created by a protocol, for users, but value capture is often different.

Value can be captured in more ways than in traditional businesses because of the types of tokens that are able to be created, and the underlying utility and flexibility of the blockchain back end.

But for both crypto protocols and traditional companies, the ability to capture value long-term is proportional to two things: value creation and defensibility.

Defensibility

Defensibility is the competitive advantage of a protocol. It describes how much value can be sustainably captured before comparable utility is offered by a competitor.

The more defensible a protocol, the more value it can capture, and the more overtly it can do so.

Maximizing defensibility results in a monopoly.

In Peter Thiel’s famous talk at Stanford, he describes why you want to have a monopoly in your industry – monopolies can capture nearly all of the value they create.

It’s difficult to have a monopoly in crypto, as it’s hard to build defensibility – how do you compete when your competition knows your secrets?

Still, there are various ways to build defensibility, and the more defensibility you have, the more value you can capture.

Tokenomic leverage

The ratio of value captured to value created is called tokenomic leverage. Higher tokenomic leverage in a tokenomic mechanism or protocol overall is analogous to higher profit margins in a traditional business.

Tokenomic mechanisms further up the hierarchy have higher leverage. And it’s possible to have a tokenomic leverage greater than 1 – indicating more value is being captured than created.

Users of Synthetix can create sAssets – synthetic TradFi assets collateralized by several times their dollar value in SNX tokens.

Synthetix governance decides this collateralization requirement, but it generally stays between 300% and 500%.

This means that SNX will necessarily be worth 3-5 times the value of all necessary sAssets.

So the tokenomic leverage of this mechanism in the protocol is between 3 and 5, depending on the current collateral requirement.

Synthetix’s collateralization mechanism introduces economic security issues only mitigated by active management of the c-ratio, and heavy inflation. As a result, Synthetix has begun to pivot its design toward other tokenomic mechanisms with lower value capture – but not for fear of competition.

Synthetix still has a monopoly on synthetic assets in the Ethereum ecosystem. If economic security were not also a concern, SNX could retain its inordinate tokenomic leverage.

This is only possible because the protocol has a monopoly; higher tokenomic leverage requires extreme defensibility.

Capturing value creatively

In traditional businesses, profit comes at the consumer’s expense – there is a direct tradeoff between value creation and value capture.

McDonald’s Corporation, however, is a notable exception.

McDonald’s share price has grown nearly 1,000,000% in its 58-year history – and they didn’t do it charging $12 a burger.

McDonald’s is a real estate company – it accumulates properties and rents them out to franchisees, selling them when appropriate.

This alternative method of value capture enables McDonald’s to subsidize their actual product – burgers and fries – crippling the competition and making for a defensible business, while still capturing value for shareholders.

McDonald’s alternative means of monetization is a prototype of mechanism design, the most crucial aspect of tokenomics.

Mechanism design is the construction of sets of incentives to create desired outcomes. Good mechanism design follows the principles of tokenomics, which are the focus of the demand-side tokenomics framework.

Curve’s CRV

Curve gets a lot of press, both good and bad for its vote-escrowed or ve tokenomics.

But Curve’s ve tokenomics are only a part of its creative value capture methods.

Like McDonald’s, Curve subsidizes their product, trading, with their alternative method of value capture.

Curve’s captures value through bribes – the more bribes being paid to LP’s, the more demand there is for CRV.

The subsidization of trading fees is also proportional to the value of bribes paid to LP’s.

Systemic consequences

Navigating the hierarchy of value capture is a stumbling block for most protocols designing their tokenomics.

Failing to see the problem clearly, many protocols overcompensate in capturing value.

When a protocol captures too much value, attempting to use their own token as a medium of exchange for example, they alienate users, enabling their competitors to copy their protocol without using a native token, capturing value through fees or another tokenomic mechanism with tokenomic leverage.

If a protocol captures too little, they lose out on the opportunity to capture value at all, and doom any competitors to the same fate.

Uniswap’s failure to capture value from the start led to the need for Curve to capture value creatively in the first place.

But in reality, Curve didn’t only capture value creatively.

Curve had to create additional utility to compete with Uniswap, because Uniswap had set the AMM market’s barrier to entry at zero value capture or less.

Subsequent AMMs capture even less value, issuing evermore inflationary tokens to subsidize their operations; as a result of Uniswap’s initial failure, all future AMMs are forced to capture negative value just to compete.

And while Curve’s innovation of ve tokenomics was clever, Curve would have been able to capture more value, with better margins had Uniswap captured value as well.

Avoid at all FOSS

Arguably the worst fate for crypto would be to follow in the footsteps of the FOSS (free, open-source software) movement.

Linux was built by similarly ideologically motivated developers who believed, as a faction of crypto does, that software should be free.

The result was unsurprising: software with poor UX, which most people hate.

Linux has been relegated to a small percentage of computer users, while competitors Apple and Microsoft were left to capture inordinate amounts of value extractively because of the duopoly they were left with.

Crypto has a unique opportunity to do open-source right; in Linux’s day, the internet had no native currency – no way to transfer value, charge microtransactions, or accrue value to native assets.

Now, there is more opportunity than ever to create valuable, yet open-source software and get paid for it.

The study of that monetization is called tokenomics.

Conclusion

Tokenomics can be hard to get right, and there’s a lot riding on them, both for your protocol and for the broader industry.

We walk founders and developers through these important questions with the Demand-Side Tokenomics framework – a series of questions and worksheets designed to evoke the optimal design for your protocol based on the principles of tokenomics.

If you’re building a protocol and would like help, or a step-by-step guide on how to design for optimal utility, token price, and longevity of the protocol, reach out to us and tell us what you’re building.

Tokenomics 101: The Principles of Tokenomics

Tokenomics describe the relationship between a token’s use and its price. Done right, tokenomics can align the interests of protocol participants, leading to a valuable token, and securing the protocol from economic exploits.

Designing a protocol requires keeping track of many moving parts – to this end, it is helpful to have a framework.

Enter demand-side tokenomics.

The demand-side tokenomics framework can be distilled in three principles: utility, value capture, and economic security.

There are tradeoffs between each of them, so the goal of tokenomics, according to the framework is to maximize the aggregate of these three.

Utility

Utility is the usefulness of a protocol to all participants.

There can be multiple groups of participants in a protocol. To maximize utility, these groups’ interests should be synchronized.

This can be done by matching demands of each group.

For example, MakerDAO matches the wider market’s demand for stablecoins with degens’ demand for leverage.

Value Capture

The second principle of tokenomics is value capture.

Many protocols create value – utility, but fail to capture any of the created value to a token.

For example, Uniswap has $1.2 trillion in all-time trade volume, but UNI sees none of it. Uniswap has never charged, and plans never to distribute fees.

Use of the Uniswap protocol is completely uncorrelated with the value of its token.

Because they didn’t capture value initially, Uniswap can’t capture value from the utility it creates.

Value capture comes from the strategic inclusion of tokenomic mechanisms – ways a token is used in a protocol.

Value captured through tokenomic mechanisms (e.g. staking, collateralization, buyback-and-burn) varies.

Value captured by a protocol can be modeled, and mechanisms compared based on value capture and economic security.

Economic Security

Economic security is the third principle of tokenomics.

Economic security is distinct from technical security – technical security comes from an absence of bugs in the code; economic security entails a lack of vulnerabilities in the incentives.

Vulnerabilities in the incentives enabled three major exploits in 2022 – the collapse of Terra, the Mango Markets exploit, and the Aave liquidity exploit were all economic, rather than technical security issues.

Conclusion

There are tradeoffs between each of these principle, and successful protocols maximize the aggregate of the three.

Tokenomics is challenging to get right, especially because of the associated technical complexity of writing smart contracts.

It’s helpful to have a framework when designing the tokenomics of your protocol.

The demand-side tokenomics framework is what Eat Sleep Crypto uses to teach tokenomics to developers in the Tokenomics For Founders 6-week intensive course.

Space is limited, so apply now to be a part of the next cohort.

Building Valuable Hyperstructures

Hyperstructures are a new type of public good – one which is truly public, and can’t be taken away.

They are built on blockchains, so they inherit blockchains’ properties, and then some.

Hyperstructures are protocols with the following attributes:

I am awed by ‘s Jacob’s articulation of these ideas; Hyperstructures is a masterpiece.

I have one caveat, and it’s about the biggest existential risk to crypto – lack of value capture.

Hyperstructure token value

Hyperstructures are only valuable when designed to capture value.

Almost none are.

Token prices are 99% speculation; their price floor, aka utility value – the price at which the market buys them up – is less than 1% of the price.

Many tokens have no price floor at all.

Most hyperstructures are valuable in the sense that they have utility, but they are not financially valuable – they lack ways to capture or accrue that value to a token.

High prices are temporary, fueled by speculation.

The UNI fee switch

Jacob says the right to turn on Uniswap’s fee switch gives Uniswap’s UNI value.

Not exactly.

If the fee switch is turned on, participants in the Uniswap protocol will leave.

To capture value, Uniswap need to make a v4 so good that it’s worth the fees.

Hyperstructure valuation

There are other reasons given for high prices of hyperstructure tokens:

- Governance

- Use of a token to pay fees

- Protocol use

- TVL

These features can be useful and necessary, but they still don’t capture value.

Governance tokens

Pure governance tokens are not valuable, for the reasons given about Uniswap above.

They fail to capture value, and the hyperstructures they govern are their own competition.

Fee tokens

Use of a token to pay fees within a protocol does not capture much value.

Fees are a small part of all value in a protocol.

Each token is used more than once – velocity – so all tokens together only capture an even smaller part of the total value in a protocol.

Protocol use

Just because a protocol is used does not mean its token will have a high price.

A token must be used in a protocol for it to capture value.

Supply and demand for the token must be aligned with protocol use.

Total Value Locked

Total value locked in a protocol, TVL does not merit a high price for the protocol token.

When TVL is not increasing demand for the token, there is no relationship between TVL and token value.

TVL does not capture value unless it is made to.

This is true for L1’s, including ETH.

Hyperstructure value capture

There are two basic ways for hyperstructures to capture value:

1. Charging fees and giving them to tokenholders

2. Requiring the native token as a medium of exchange within the protocol.

The first is a security, the second is a currency.

Charging fees

Charging fees to use a hyperstructure captures value.

Fees can be at a protocol level (SushiSwap), or on top of a protocol (OpenSea).

Note: it’s illegal to give token holders these fees in the US.

That said, hyperstructures are permissionless; this is not legal advice.

Equities vs currencies

Currencies and companies don’t capture value the same way.

Companies capture value by taking profits.

Currencies capture value through use as a medium of exchange.

Hyperstructures can capture value in either way, but the token and protocol must be designed to do so.

Conclusion

Building valuable hyperstructures is hard.

If you want to capture value, you need to include ways to do so from the beginning.

You can’t just do it later.

For this reason:

Crypto is the only industry where you can create a billion dollars of value from nothing and not see a penny.

Not because someone takes that value, but because you fail to monetize.

Without value capture, builders of hyperstructures will not be compensated.

If you need help with value capture or would like input on your project’s tokenomics, reach out to us for a free consult.

Value Capture and its misconceptions

Value capture describes the way a business, protocol, or cryptocurrency retains a percentage of its revenues.

Misconceptions about value capture abound.

There are two types of mental mistakes people make – biases, utilitarian and teleological.

Utilitarian bias

Peter Thiel summarizes the first in Zero to One:

“Your company could create a lot of value without becoming very valuable itself.”

Thiel compares returns between major airlines, and software companies.

Airlines operate on thin margins. Software companies have marginal cost of replication.

In 2012, airlines’ revenue was $160 billion. Google’s was $50 billion, but at a 21% profit margin, Google was over a hundred times more profitable than the airline industry.

Valuable protocols != valuable tokens

Lack of value capture isn’t unique to TradFi; in fact, it’s more common in free, open-source software.

As an outgrowth of FOSS, cryptocurrency (ironically) also suffers.

Many in crypto assume the tokens of a valuable protocol will necessarily be valuable. Most of the time, developers haven’t considered tokenomics, and there is no relationship.

Teleological bias

Teleological bias reverses causality.

It implies an imaginary force in an incomplete chain of dependencies.

“x is valuable because y depends on it,” where it isn’t a given that y will remain stable.

For example, “BTC must continue to go up because the Bitcoin network’s security depends on it.”

This type of rationalization is a red flag, but quite common.

Financial interest blinds people.

“It is difficult to get a man to understand something, when his salary depends on his not understanding it.” – Upton Sinclair

Labor Theory of Value

The Labor Theory of Value is another example of teleological bias – which describes the tendency to reverse causality to retrofit a set of beliefs.

Early Bitcoiners said Bitcoin derived value proportional to the electricity spent on it.

Things are valued for what they give, not what they take.

Electricity, required to mine BTC, is a driver of costs, not value.

Conclusion: Systemic Risk

These biases are a problem partly because their premises are true.

Cryptocurrencies need to be valuable to secure protocols.

In most cases, they’re not.

Thought is rarely given to what makes a token valuable. Consequently, protocols behave unexpectedly, collapsing and their tokens dropping 99% in bear markets.

The increasing interdependence of blockchains compounds this issue. The cryptocurrency ecosystem is rife with risk.

Thankfully, builders are beginning to notice these risks, and how to deal with them.

Cryptocurrency often likened to Jenga – one block away from complete collapse.

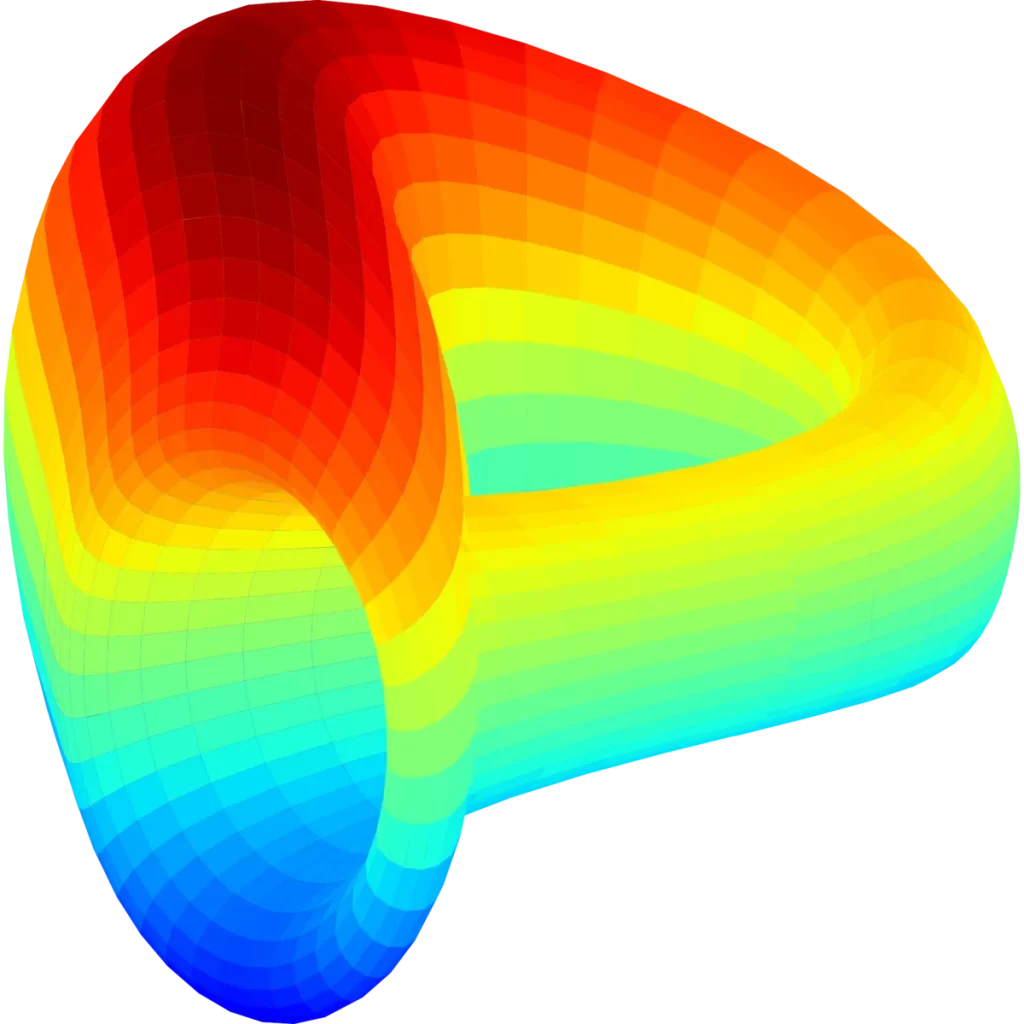

I see crypto as a pyramid.

We’re building one layer at a time. Sometimes we build too high, without laying the previous foundation. Those who build ahead fall from real heights.

But it doesn’t stop those building at the bottom.

Thankfully, people are starting to tune into this.

Each bull market, the cryptocurrency ecosystem builds another layer.

So far, the approach has been to let it settle, see what falls.

But there is a better way.

In the pyramid analogy, tokenomics are the concrete that hold everything together.

By intentional crafting of tokenomics, cryptocurrency protocols can be made to capture value, giving them the economic security needed for a strong foundation.

If you’d like to learn more about tokenomics and how to design valuable cryptocurrencies, check out Tokenomics 101.

Terra (LUNA) Tokenomic Post Mortem

Terra is a base-layer (L1) blockchain with native asset, LUNA, used primarily to collateralize the Terra ecosystem’s stablecoin, UST.

This week, the UST stablecoin lost its peg to the dollar, causing a “death spiral” that brought LUNA down from $90 to $0.

It was an unprecedented event whose implications are still being worked out in the crypto space.

Takes on the fundamental reason LUNA crashed range from “it was an inside job” to “20% yields are unsustainable,” with “LUNA itself was undercollateralized” and “LFG, the Terra treasury mismanaged funds” falling in between.

Shady dealings not withstanding, it was Terra’s tokenomics that caused its demise.

Examining LUNA’s fundamental value

All currencies get their value from use as a medium of exchange.

Cryptocurrencies are no exception.

In LUNA’s case, this value comes from use as collateral.

LUNA collateralizes UST, and LUNA holders make decisions about the protocol – governance.

Like all pure-governance tokens, LUNA doesn’t derive much value from its ability to make these changes.

Most of LUNA’s value came from the belief that it would be used as collateral for borrowing UST.

Terra: a short summary

Over the past two years, Terra ascended to the top of CoinMarketCap, fueled by “guaranteed” returns on Anchor Protocol.

In March, founder Do Kwon announced Terra would buy $10 billion in reserves, to fortify LUNA.

By May, ~$2.5 billion in BTC had been accumulated by LFG, the Terra treasury, but there were $14 billion UST outstanding, making Terra an easy target since the foundation couldn’t cover deposits.

Taking profits in stablecoins like USDT, DAI, and UST is popular way for traders keep money the ecosystem, and avoid centralized exchanges.

UST holders were attracted for this reason, but the fundamental driver of Terra’s growth was 20% yields on stablecoins deposited into Terra’s Anchor protocol.

On May 12, series of shorts on UST caused it to fall below $1.00.

Over the next few days, a bank run followed.

UST fluctuated wildly, causing Terra to mint new LUNA by design, and prompting LFG to sell its BTC reserves for LUNA, hoping to bring the UST peg back to $1.00.

It didn’t work; the crypto community had lost faith in UST, recognizing Anchor as a pyramid scheme.

After several days, facing a hopeless situation, Terra network validators paused the blockchain to prevent further attacks.

Lessons from Terra (LUNA)

LUNA’s use was rather limited. It was primarily used to create UST.

Irrespective of LUNA’s sizeable Total Addressable Market – a multiplier of demand for stablecoins – LUNA’s TAM is fickle.

Anchor’s 20% yield ultimately depended on LUNA’s continued growth.

A few takeaways:

- Cryptocurrencies get their value from use as a medium of exchange.

- The resilience of a cryptocurrency depends on the diversity of its economy. LUNA was used for a single purpose; when Anchor failed, LUNA failed.

- All value is belief.

- Once the belief that LUNA could create UST was shaken, the price spiraled.

- To Terra’s credit, it (still) has lots of supporters, and a vibrant community, but even this isn’t enough to fix bad tokenomics.

- Tokenomics must be sustainable. Without sustainable tokenomics, projects risk stagnation or collapse.

The bulk of the implications from Terra’s collapse are likely to play out over the coming weeks and years. In such an interconnected system, these effects are not immediately obvious – tokenomic design can be complex.

If you are creating a token and would like some help with tokenomics, feel free to reach out for a free consult.