Bitcoin has been on some wild rides the past few years. Hitting a crescendo of $20,000 in December 2017, BTC dropped to $12,000 just days later and stumbled down to $6,200 over the next two months.

Many people panicked: some trading in and out, others HODLing all the way down. Weathering 80% losses takes discipline, but the promise that Bitcoin might boom again keeps speculators invested. Bitcoin’s history of consistent, outrageous returns is compelling for those taking a long view. “Taking a long view” requires understanding three principles: objective valuation, technical developments, and factors surrounding adoption.

For traditional investors, this speculation looks foolish. “Where are the fundamentals?” they ask. Volatile returns engender speculation, and speculation spawns volatility. High volatility plus a lack of a traditional valuation mechanism generally screams ‘pyramid scheme’ and forces more conservative investors to abandon the field to speculators. And round and round we go.

Cryptocurrency Valuation

Bitcoin, like all currencies, derives its value through use as a medium of exchange, and I’ve already demonstrated that it can be valued according to the accepted equation of exchange: MV = PQ. This equation shows that the price of a currency must be high enough to support the purchases made with it.

To illustrate this principle, let’s imagine Alice wants to buy a car from her friend Bob. (yes, for the love of Mike, it’s Alice and Bob again). Both Bob and Alice agree that the car is worth $1,000, but Bob demands to be paid in his own currency: Bob’s Car Coins (BCC).

The question immediately arises, how much is each BCC worth?

For an established currency, we could look to market data, but there is none. BCC is an entirely new currency.

Let’s say Bob wants 10 BCC for his car, but Alice has no BCC. Assuming she can exchange dollars for BCC, Alice is willing to pay up to $100 per BCC in order to purchase the car (10 BCC multiplied by $100 per BCC equals $1,000.)

In this transaction, Bob doesn’t explicitly tell Alice the price of each BCC, but he does give his currency value by choosing to accept payments in it. In this example, we see the axiom that the value of a currency increases to support the purchases being made with it.

Speculation can move prices temporarily, but use as payment establishes a currency’s worth.

There are two aspects to the determination of value through fundamental analysis: applying economic principles, and data extrapolation. In cryptocurrency valuation, the second informs the first.

Economic Principles

As illustrated in the example, using a currency as a medium of exchange gives it value. We see this principle applied in the equation of exchange. Fundamentally, if we know the total value of purchases with a cryptocurrency and the velocity of the currency, we can determine the price of each unit. Velocity is the average number of times a unit is ‘recycled’ in a specified time frame. With these variables, the equation of exchange (MV = PQ) is easy to solve algebraically.

Rewritten to solve for M, the monetary base, the equation of exchange reads M = PQ/V. You can read the full explanation in previous Eat Sleep Crypto articles. In short, this means that the value of circulating currency is equal to the total value of purchases made with that currency, divided by the average number of times a unit of currency changes hands.

After solving for M, we can determine the value of each unit by dividing M by the circulating supply of each coin. We do this in several examples on Eat Sleep Crypto, including the Investor Series #1 – Bitcoin valuation article.

Data Extrapolation

While it appears satisfying and conclusive, fundamental analysis is not the only approach to currency valuation. We can also forecast future prices based on expected use of cryptocurrencies as a medium of exchange. In the Bitcoin article, we use the SWIFT network as a proxy for global transactions. Data extrapolation, in this case, involves substituting Bitcoin for the SWIFT network. Our model yields a conservative estimate of $50 million per bitcoin by 2030, employing our own assumptions. (If you’re interested in seeing a copy of our model, say something in the comments below.)

$50 million per bitcoin may sound like hyperbole. It’s not. The SWIFT network does over a quadrillion dollars in transactions per year: a thousand trillions!

This analysis doesn’t factor in transactions from commercial payment systems like Visa and Mastercard, Paypal, or cash payments, all of which are vulnerable to replacement by crypto. But, it does assume adoption of crypto as a medium of exchange, when in reality immediate adoption is not the top priority for most cryptocurrency developers.

Despite the justifications referenced above, some proponents of Bitcoin continue to dismiss it as a medium of exchange. There are two reasons why. The first is the “store of value” narrative and the second is Bitcoin’s “greater fool” theory.

Bitcoin: A Peer-To-Peer Electronic Store Of Value

People who promote Bitcoin as a “store of value” argue against its use as a medium of exchange. Discounting entirely that Bitcoin is far too volatile to be a store of value in the short term, there is so much irony in this position. As good “stores of value” need fundamental properties to make them desirable, good currencies are inherently stores of value and command higher prices because of it.

The long term value proposition of Bitcoin or any other cryptocurrency is significantly greater as a medium of exchange than as a store of value. Estimates of Bitcoin’s value if it replaced gold entirely is only $4 million dollars per coin. That’s more than an order of magnitude less than its conservative value as a medium of exchange.

While the BTC community fritters away it’s first-mover advantage, most other cryptofolk are driving adoption where it’s needed least. If you think of cryptocurrencies as products solving a problem, you can’t help but see that the largest markets, in terms of numbers of customers, are being ignored

A large percentage of early Bitcoiners have first-world origins. Adoption evangelists have therefore been active in those countries – exactly where a volatile, traceable, alternative currency is of little use. While BTC supporters have rejected Bitcoin’s purpose as a peer-to-peer electronic cash system, even those who imagine scaling via the Lightning Network haven’t considered the technical and economic limitations of third-world users. Not to mention the limitations of the Lightning Network itself!

Bitcoin’s Greater Fool Theory

Some advocates of Bitcoin believe that others will purchase Bitcoin because of greed and fear of missing out. As a consequence, they drive the price up. These advocates assume BTC can scale and that it will eventually become a store of value once it reaches its final price. In their minds, this culminates with institutions FOMOing into BTC as an investment.

These arguments imply that cryptocurrencies have no fundamental drivers of value. In reality, cryptocurrencies have a stronger value proposition than almost any other asset class. Because of blockchain’s transparency, we’re able to quantify cryptocurrencies’ worth.

The Importance of Adoption

Many cryptocurrency advocates across communities imagine that cryptocurrency will take hold in places like the US and Europe, and then gradually catch on in third world countries.

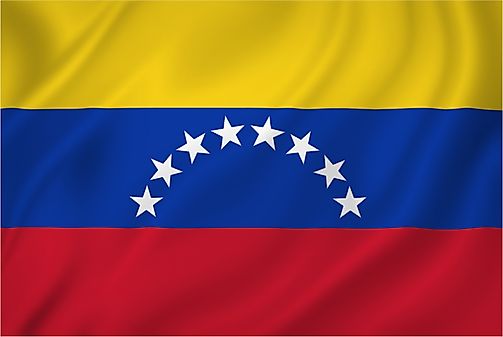

The reality is, first world users don’t need Bitcoin. But Venezuelans do.

Ironically, if adopted as a medium of exchange or “means of payment”, cryptocurrencies would see less volatility and eventually be adopted by the first world for payments. This decrease in volatility happens within an economy as purchases of the currency happen more frequently. A larger volume of commercial transactions offsets currency volatility. Further stability comes as goods and services are denominated in it.

Price Denomination

The denomination of goods and services in a currency creates strong price support. A quick thought experiment suggests that if someone knows they can buy the same meal for 0.1 BCH each time, they’re able to benchmark the price of other things in it, too. The axiom here is that people value a currency based on what it buys.

This is the same principle we see in our illustration with Alice and Bob. We can value each BCC Alice received from Bob at $100, despite neither of them officially setting the price. In this case, it was because we know that each BCC got Alice 1/10th of a $1000 car.

Closing Thoughts

With widespread adoption as a medium of exchange, Bitcoin, or any cryptocurrency, will become more stable due to the volume of purchases.

The key here is that ‘stability’ is relative. It’s relative to the price of goods, and the price of other currencies. Compared to a currency like Venezuela’s bolivar with 1,000,000% inflation against the USD, Bitcoin’s 80% drop is nothing. Fittingly, it’s through adoption in countries like Venezuela that cryptocurrencies can gain the necessary stability for worldwide adoption, while filling desperate demand for a sound currency.

With all this in mind, I was thrilled to hear about Bitcoin.com’s recent announcement of the initiative to onboard 500 merchants a month in Venezuela. Adoption like this raises prices and reduces volatility. The more adoption a cryptocurrency has as a medium of exchange, the more valuable it will be, and unlike a purely speculative asset, its volatility actually decreases with volume.

I’m looking forward to seeing meaningful adoption of all cryptocurrencies, and eager to see the shift in focus of cryptocurrency users from speculation to fundamentals as we witness the benefits that cryptocurrencies bring to the world.