In traditional finance (TradFi), the Price-to-Earnings (P/E) ratio is used to assess the relative attractiveness of a stock.

P/E is calculated by dividing the price per share of a company’s stock by its earnings per share (EPS). The formula is: P/E Ratio = Stock Price / Earnings Per Share.

A high P/E ratio typically indicates that investors are willing to pay a premium for the company’s earnings, which suggests they have high growth expectations. A low P/E ratio may indicate that the company is undervalued or that investors have lower growth expectations.

There are other ways to interpret P/E, but exploring these is beyond the scope of this article.

Valuing Cryptoassets

Valuing cryptoassets is clearly different than valuing stocks, but how has not been entirely clear to most. What is clear is the desire for a metric like P/E to measure the relative value of cryptoassets.

Market Cap

Market cap was an early attempt at such a metric. Market cap is borrowed from equities; it’s calculated as price times shares outstanding.

Market cap is flawed to begin with – the “marked-to-market” fallacy underlies many economic security exploits, but ignoring this, it’s a blunt tool borrowed from traditional finance.

Alternatives have been proposed, including Nic Carter’s “realized cap” and our circulating supply, but again – these metrics do not tell the full story, and are only applicable to some cryptoassets.

TVL

TVL, total value locked is another metric which has been proposed. The issue with TVL is that most protocols’ tokens don’t directly benefit from increased TVL. Their value is loosely correlated to TVL, at best. At worst, TVL is more of a liability than an asset. In Bitcoin, for example, onchain assets which are bridgeable out of the ecosystem can be profitably double-spent.

Fees

Fees are an useful metric for some protocols, but even in these cases, fees don’t tell the whole story.

Even tokens to which protocol fees accrue value are not 1:1 analogs.

Ethereum

Tokens are valued according to their tokenomic mechanisms – the ways they are used in a protocol which cause them to accrue value.

ETH gets some of its value through fees, but also accrues value through other mechanisms: use as a medium of exchange, as collateral, and through coin burns in EIP-1559.

This unique combination of tokenomic mechanisms causes ETH to accrue value differently than other tokens, even those which are used to pay fees.

Monero

XMR is also used to pay for fees, but most of its value comes from its use as a medium of exchange. This makes monetary base and circulating supply more relevant when comparing XMR to other cryptoassets.

Synthetix

Synthetix allows users to speculate on assets not native to Ethereum via its sAssets, synthetic assets backed by ~400% of their value in SNX tokens. Synthetix also takes fees, but it’s the TVL that most directly affects the value of SNX.

SNX’s price floor is proportional to the value of assets collateralized by SNX, and the collateralization ratio or, c-ratio.

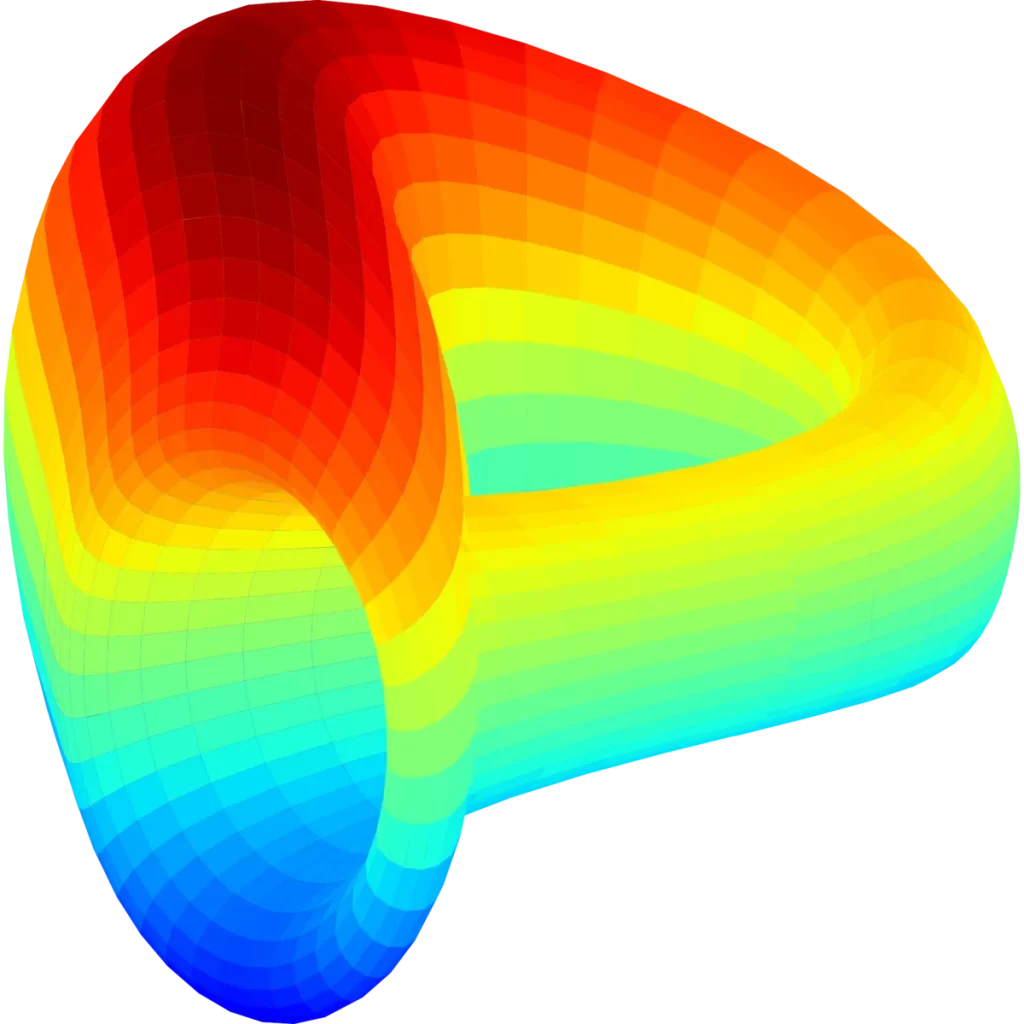

Price Floor

A tokens’s fundamental value is reflected in its price floor – the minimum possible price for it to sustain before overwhelming demand buys it up on the order books.

Another way to describe a price floor is the price of a token if all speculators were forced to sell.

Price floor is absolute, like the book value‡ of a stock, but not that valuable in isolation.

In bear markets, you can take advantage of price floors on red days by placing strategic buy orders, but most tokens rarely hit their price floors, though there are notable exceptions.

Price-to-floor, P/F

A token’s price can be envisioned as its price floor, plus a speculative premium.

Together, the price and price floor provide a measure of risk.

If you can accurately identify a token’s price floor, you can find its P/F.

Price-to-floor, then, is a measure of risk/reward of investing in a token.

This ratio can be used to compare all crypto assets over time, and relative to each other.

Conclusion

P/F is just one metric. As with equities, no single metric tells the whole story. But like P/E, P/F provides a lot of color.

As crypto matures, P/F will become even more useful to investors. For now, it’s a good measurement of the risk-reward of an asset.

None of this is financial advice. If you’d like more insight into how exactly to calculate price floors, P/F, and other metrics, I’ll be hosting a class where we walk through the examples listed here in more detail, as well as other examples of tokenomic mechanisms, valuation practices, and heuristics to identify valuable tokens and protocols.

Sign up for this one-time offering here.

* When price dips below price floor, the market purchases a token in speculators’ absence

‡ More accurately, the liquidation value of a company’s assets and liabilities